Real Estate Tokenization in US 2026

A practical guide to real estate tokenization in the US in 2026. Learn what tokenized deals really represent, what tokenization can improve (including global investor outreach), and where projects break in compliance, liquidity, custody, and recordkeeping.

If you are thinking about real estate tokenization in the US — as a sponsor raising money, an investor looking for exposure, or a team building a platform — this guide is here to help you make a clear decision.

Tokenization can be useful. It can also create new ways to fail if you treat it like “just mint tokens.” In 2026, the real work is still legal, compliance, and day-to-day operations. The token is only the format.

What “tokenized real estate” usually means in real US deals

In US practice, tokenization usually turns an investor’s rights into digital units (“tokens”) tracked on a ledger. Those rights are typically rights in a property-holding entity (like an LLC or LP), or rights under a contract tied to the property’s cashflows. The token is the wrapper. The enforceable promise is still written in legal documents.

Many people imagine the deed moves when the token moves. In the US, that is usually not how it works.

In most real projects, a token represents a security claim, such as:

- equity in an SPV (for example, an LLC) that owns the property, or

- a note or contract claim linked to property cashflows.

The deed still lives in county land records under state property law. A blockchain transfer does not update those records by itself. So the key question is simple: what do you actually own?

Your rights still come from documents: the operating agreement, offering documents, the note, transfer rules, and investor terms. The token can help track and move that claim, but it cannot replace the legal stack.

What tokenization can genuinely improve

There are real positives when tokenization is done with discipline.

First, tokenization can support global investor outreach. A digital investor flow can help you reach more investors across regions, with a clearer online process (when your offering path allows it). This can matter for sponsors who want broader demand and for investors who want access to assets outside their home market.

Second, tokenization can make fractional access easier. Smaller ticket sizes can bring more investors into a deal, especially when a traditional structure would be too heavy for many small holders.

Third, tokenization can reduce cap table pain. If the project treats the token ledger as the main record, it can be easier to track balances, transfers, voting snapshots, and notices at scale.

If you want the “how it works” flow before you go deeper, the step-by-step workflow explains the tokenization process.

If you want a simple benefits overview, the benefits guide explains global access and other positives.

Important: these gains show up only when legal, compliance, and operations are already tight. If your documents do not clearly connect investor rights to the token record, the token becomes a label, not a system.

Why Real Estate Tokenization in US 2026 is structurally constrained

In the US, many real estate tokens are securities in substance because they look like equity or debt sold for investment return. The token format does not remove securities law duties. It often adds new failure points because mistakes can spread faster.

That is why your offering path shapes your product:

Regulation Crowdfunding (Reg CF) is a common example of how rules set hard limits. It must run through an SEC-registered intermediary, it has a raise cap, and securities generally cannot be resold for one year (with limited exceptions).

Other paths (like Regulation A or Regulation D) change the trade-offs, but the pattern stays the same: who can buy, how you can market, and how resales can work are not “nice-to-have details.” They decide what the product can honestly promise.

Why “liquidity” often breaks in practice

Tokenization is often linked with the idea of liquidity. In US 2026 setups, liquidity breaks more often than people expect — not because the smart contract fails, but because the surrounding system is heavy.

A hard truth is that “transfer” has two meanings:

- the token can move technically, and

- the transfer can be lawful and recognized under the offering’s rules.

A wallet-to-wallet transfer can still be invalid if resale restrictions, buyer eligibility, approvals, or venue requirements are not met. That is why teams discover too late that “the token moved” is not the same as “the security was legally transferred.”

Also, lawful secondary trading often needs a compliant pathway. Many teams run into ATS questions once they try to support real resales. FINRA’s overview describes an ATS as an SEC-regulated trading venue and notes the broker-dealer / oversight obligations that can apply.

This does not mean “secondary is impossible.” It means it is a real project scope item, not a feature checkbox.

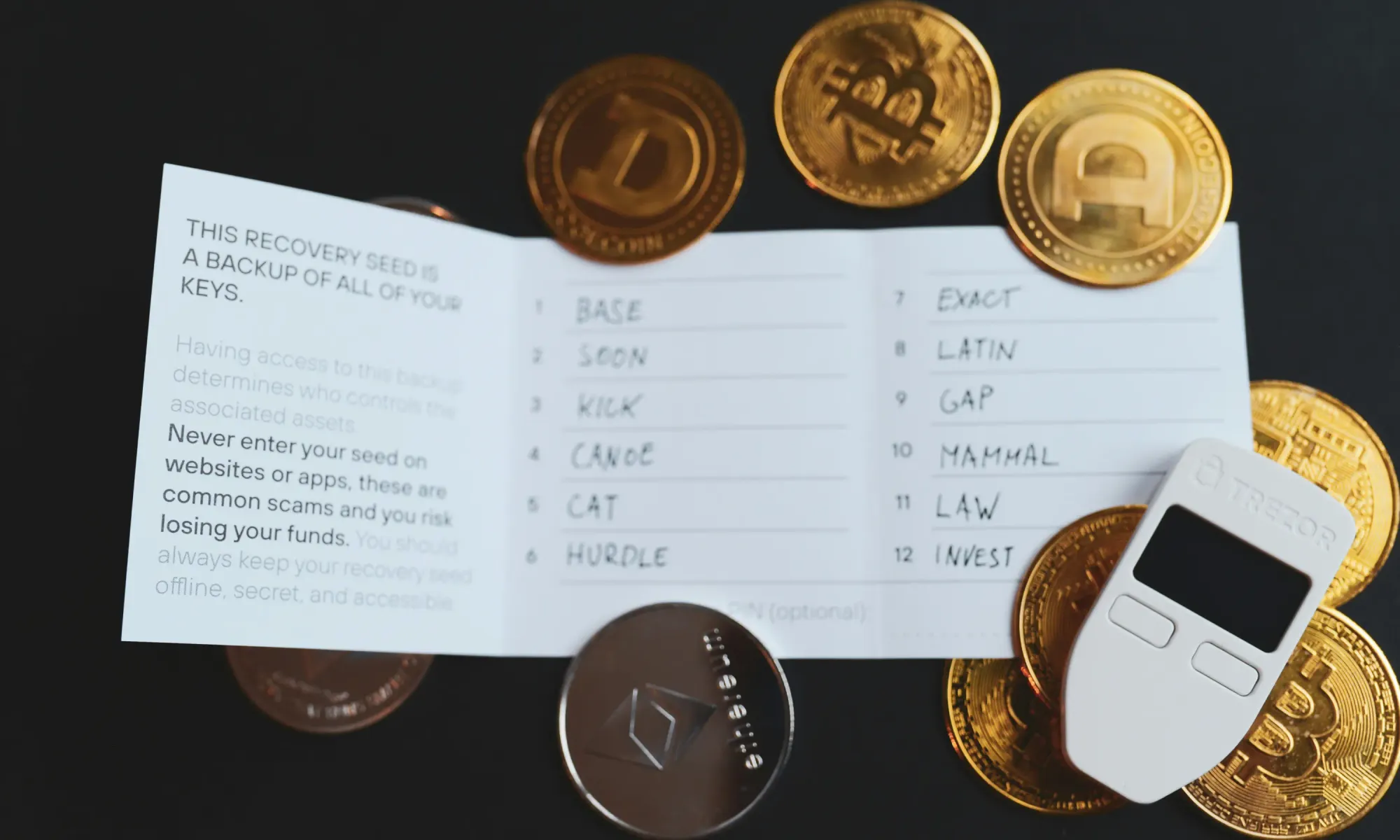

Records and custody: where real failures happen

Two operational issues decide outcomes more than most teams expect: recordkeeping and custody.

Recordkeeping risk shows up when you have two “sources of truth”: an on-chain ledger and an off-chain register (transfer agent, admin system, or internal records). If they stop matching, you get ownership disputes, blocked transfers, or wrong distributions. This can happen through normal events like wallet changes, key loss, burns and re-issuance, or corrections after mistakes.

Custody risk is also real. Keys can be lost. Wallets can be compromised. Transfers may need to be frozen or handled under legal order. These problems usually appear later, when the deal is already live and exceptions start to happen. A serious tokenization setup needs clear policies and tools for exceptions, not only code.

If you are planning scope and budget, the cost breakdown shows what projects pay for in 2026 (legal, compliance, tech, admin, marketing).

When tokenization makes sense in the US in 2026

Tokenization tends to work when you treat it like a securities + investor-operations product.

It can make sense when:

- you have a realistic compliance path and clean documents,

- you expect enough investor volume that digital controls are truly useful,

- you can run the full lifecycle: onboarding, transfer controls, reporting, distributions, and exception handling,

- and the deal still makes sense even if secondary liquidity stays limited.

It usually does not make sense when the deal needs “automatic liquidity” to look attractive, or when operations are treated as a one-time setup.

A helpful way to pressure-test expectations is to compare with known models. The comparison article explains tokenization vs crowdfunding in simple terms.

A practical “next step” for sponsors, platforms, and investors

If you are a sponsor, the best next step is to write down the structure in one sentence (“token = equity in SPV” or “token = note claim”), then check if your documents and transfer rules match that sentence.

If you are building a platform, the best next step is to design around controls first: eligibility checks, transfer rules over time, recordkeeping, distributions, and exception handling. The token should be the last part, not the first.

If you are an investor, the best next step is to confirm three things from documents (not UI): what you own, what cashflows you have rights to, and what limits apply if you want to exit.

Tokenization can be a strong tool in 2026 — especially for global reach and cleaner ownership management — when it is built like a real regulated product.

Conclusion

Real estate tokenization in the US in 2026 is best understood as a way to run a regulated real estate security with better digital rails. It can support wider reach, clearer ownership tracking, and smoother investor coordination — but only when the legal stack and operational processes are strong enough to stay consistent over time.

A good test is simple: imagine the deal two years after launch, not on launch day. If you can handle resales, exceptions, and reporting without manual chaos — and if the token record, documents, and real-world operations stay aligned — tokenization becomes a practical advantage, not an extra layer of risk.